Introduction

Starting a Turo business can be a lucrative venture, but it all begins with thorough research. In this comprehensive guide, we’ll walk you through the process of researching cars for Turo, using the Turo calculator, making informed decisions, and maximizing your earnings in the exciting world of Turo car rentals.

1. Understanding the Turo Calculator

Before purchasing a car for your Turo fleet, it’s essential to use the Turo calculator. This powerful tool allows you to evaluate which cars are most likely to generate profits in your area. Here’s how it works:

- Begin by visiting the Turo calculator on their website >> Here

- Specify your location to tailor the results to your area.

- The calculator will provide you with a list of the top 10 cars that have proven to be profitable, based on Total’s data. These recommendations are invaluable as they reflect the market demand in your specific region.

In the example below, I’ve selected the Los Angeles / Riverside / Orange County area as my region and a budget range of $10,000 to $25,000 for a car.

Using Turo’s Carculator, we can identify the best car within this budget range, which happens to be a Chevrolet Spark, with an estimated value of $11,968. This car comes with an annual loan cost of $2,652 and an average earning potential of $7,852.

I have some reservations about these calculations. Turo makes several assumptions in their calculations while omitting important factors. However, let’s break it down step by step. The car’s value is $11,968, with a 10% down payment of $1,196.80, leaving a purchase price of $10,771.20. At an 8.5% annual percentage rate (APR) and a 60-month loan length, the monthly payment comes out to approximately $220.99, give or take a few dollars. This leads to Turo’s annual loan cost of $2,652.

Considering the annual cost of $2,652 for the car, Turo predicts that a Chevrolet Spark will generate an average yearly income of $7,852, equivalent to around $654.33 per month, with some variation. This implies a return on investment (ROI) of 196.1%.

While this calculator provides a useful starting point, it overlooks important factors like taxes and registration fees specific to your location, monthly car insurance, car washes, oil changes, and other potential maintenance expenses. Taking these factors into account can significantly impact the final outcome.

In the next section, I’ll present a more practical approach to calculating and identifying the most profitable cars on Turo.

2. Selecting the Right Car

The way that I would break this down is, I’ll still use turo’s calculator to get some idea and a list of the types of cars that does best. Taking that list and go searching for it on sites like carvana, or auto trader. For this example we’ll keep using the Cheverlet Spark

I’ve been using Carvana for most of my car purchases because I really dislike dealing with salespeople and the whole haggling process. That’s precisely why I opted for Carvana. Their purchasing process takes 30 minutes or less, and I’m out the door with my new car. So, use whatever method works best for you, as long as the numbers add up in the end. Hopefully, by the end of this blog, you’ll have enough knowledge to make an informed decision.

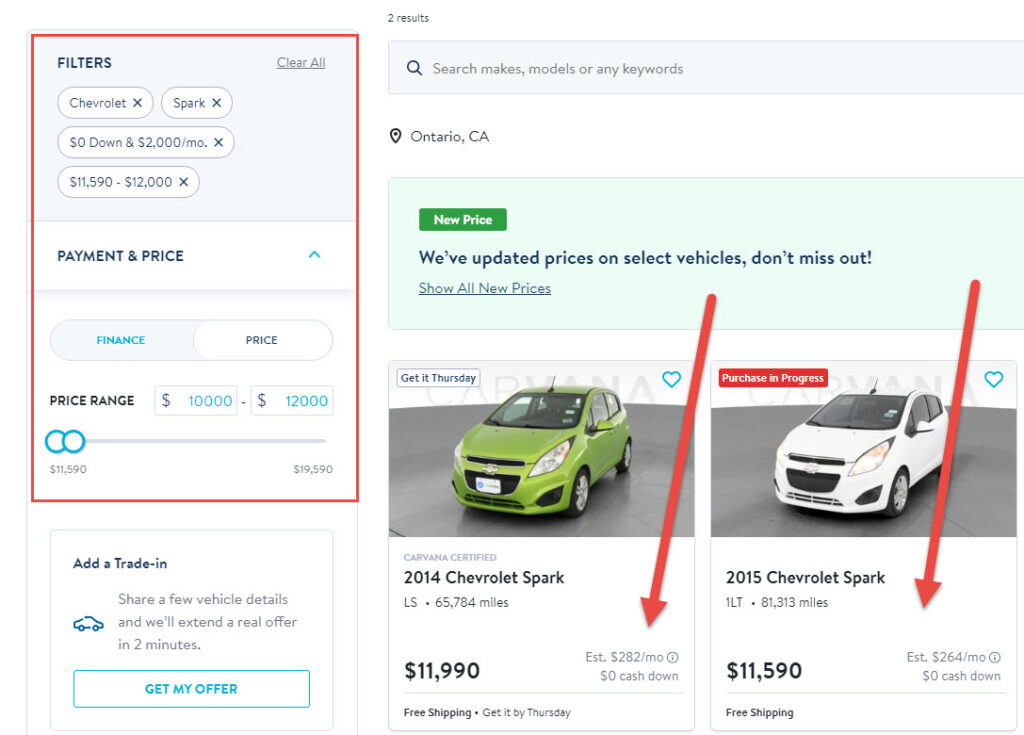

As you can see at the top, I’ve filtered for the car itself and set the price range to no higher than $12,000. Two cars that fit these criteria have popped up, making them good possibilities. According to Turo’s car listing rules, the selected car must be no more than 12 years old and have fewer than 130,000 miles. In this case, I would choose the 2014 Chevy Spark LS over the 2015 model due to its lower mileage.

Now, let’s delve deeper to determine if this car can be a profitable choice for us.

4. Finalizing the Budget

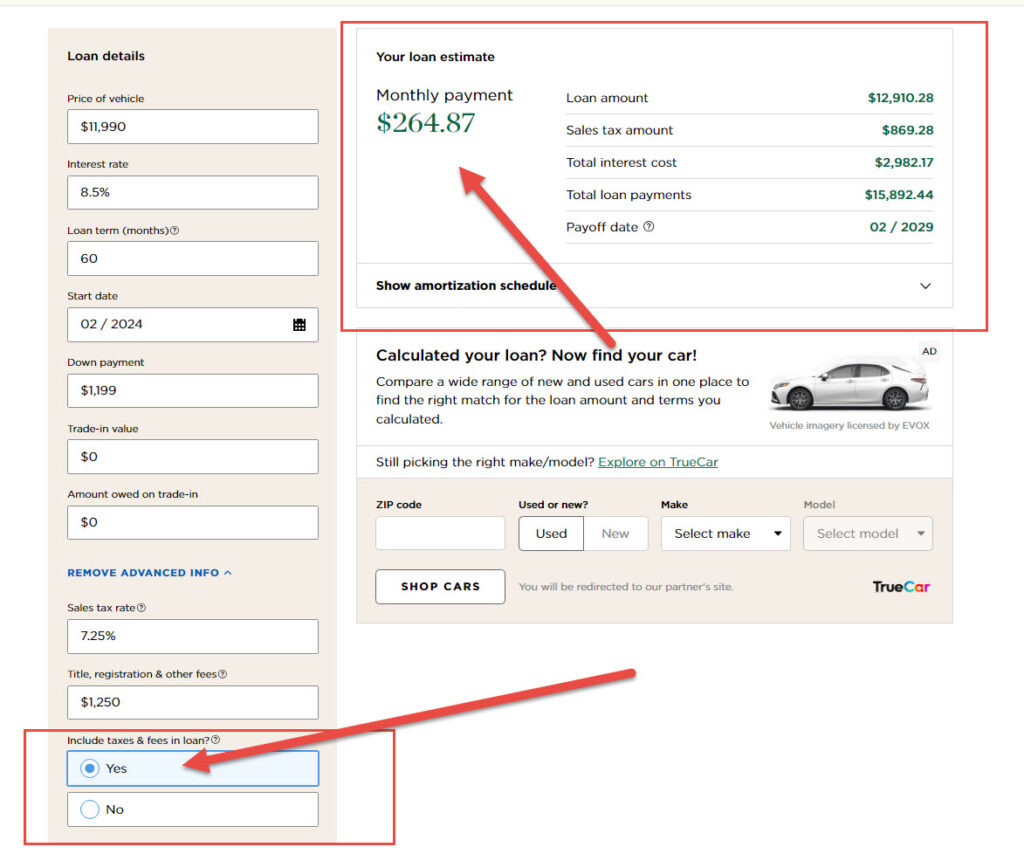

To assist me in getting a rough estimate, I used NerdWallet’s car loan calculator. This estimate includes an 8.5% interest rate (although it can be much lower depending on your credit score), a 60-month term, a 10% down payment, which amounts to $1,199, taxes at 7.25% for my area, Orange County, CA, and title and registration fees totaling around $1,250. This calculation results in a monthly payment of $264.87, which looks quite promising at the moment.

Now that we’ve narrowed down our monthly payment, let’s factor in all our monthly expenses and maintenance costs to assess our overall situation. We’ll need to include car washes, for which we pay a monthly membership fee of $20 for unlimited car washes. Additionally, I use Geico for my car insurance, which costs around $72 for this particular model and size. Don’t forget about oil changes; these occur roughly every three months, totaling about $60-70 per month, which I’ll estimate at $25 a month. Lastly, it’s crucial to set aside 10% of the expected income of $650, which amounts to $65 a month, to cover unexpected expenses like tire replacements or brake light repairs.

When we add it all up, our total monthly expenses come out to around $449.87. Considering the expected income of $654, we can anticipate a monthly profit of $204.20.

Breakdown:

- Car Loan: $267.87

- Car Wash: $25

- Car Insurance: $72

- Miscellaneous Expenses (10%): $65

- Total Monthly Expense: $449.87

- Expected Monthly Income: $654

Expected Monthly Profit : $204.20

Expected Yearly Profit: $2450.40 Which is a number that is way off of turo’s carculator.

Now, with all the numbers in place, you can now have a better idea to make a more informed decision if you wanted to get into the Turo business

Conclusion

By following this research process, you can gauge your potential monthly profit more precisely. While earnings may vary throughout the year, careful planning and selection of vehicles and finding the right financial loan can help you bring your profit margin up.

Starting a Turo business requires diligence and research, but with the right approach, you can build a profitable car rental venture. Remember to regularly monitor your earnings and make adjustments as needed to maximize your success in the Turo marketplace.

With these steps and insights, you’re well on your way to launching and managing a successful Turo business that not only generates consistent income but also provides valuable transportation solutions to your community.

Expanding on these points, researching the specific cars mentioned, discussing strategies for marketing your Turo business, and providing more in-depth information on the financial aspects can further enrich the content to meet the desired word count.

Be sure to stay tuned to our blog, as we will delve deeper into our experiences with Turo, discussing both the positive and negative aspects. We’ll also share the tools and strategies that have assisted us throughout our journey.

To learn more on what the Essential Products you need for a Turo Rental Business